Resource Goals

- Understanding your 501(c)(3) nonprofitA non-governmental organization whose primary purpose is something other than selling goods or services. organization’s obligations concerning acknowledging donor gifts under the Internal Revenue Code and Regulations.

- Understanding what a donee acknowledgment letter is and what it needs to contain (and should NOT contain) depending on the donation and circumstances.

- Understanding when and how your organization’s disclosure requirements to the Internal Revenue Service are triggered and how to fulfill them.

Introduction

Raising money is an inevitable need for most animal rescuers and sanctuaries. We offer several fundraising-related resources to help assist your animal organization with this. Record keeping is also always a key component in fundraising, planning future campaigns, tracking donors, and engaging in ongoing donor stewardship. There are also tax considerations for you to consider! One crucial part of this is acknowledging donations.

Whether you are an individual rescuer, a microsanctuaryA microsanctuary is a small scale community of human and nonhuman (generally “unconventional or farmed”) animal companions, who live together in a chosen shared lifestyle and in commitment to ending the oppression of all beings. Microsanctuaries adhere to the notion that no nonhuman member of the community should “serve a purpose.” Microsanctuaries can exist in any context: rural, suburban, or urban. A microsanctuary can consist of as small a community as one animal and one human caregiver. For more information on microsanctuary please refer to the Microsanctuary Resource Center., or a 501(c)(3) organization, it’s always essential to acknowledge and thank all donors who help you in your work to rescue and provide compassionate care to animals. Expressing gratitude and appreciation to donors helps establish a positive relationship with them. Setting a baseline for ongoing donor stewardship is key to incentivizing donors to make future donations!

If you are a 501(c)(3) charity, thanking your donors comes with an added component. It is not just about fostering positive relationships; legal requirements are associated with it. In this resource, we hope to provide guidance on the IRS requirements surrounding donee acknowledgment letters from 501(c)(3)s and give you some handy tools you can use to make this work a little easier.

We Aren’t Your Lawyer Or Tax Professional!

The Open Sanctuary Project is not a law or accounting firm, and this resource is not a substitute for the services of an attorney or tax professionals. Accordingly, you should not construe any information presented as legal or accounting advice suitable to meet your particular situation or needs. Please review our disclaimer if you haven’t yet. When developing your protocols around donee acknowledgments, consult an experienced nonprofit attorney and/or qualified tax professional for counsel.

So What Is A Donee Acknowledgment Letter, And When Is It Required?

In simple terms, a donee acknowledgment letter is a “thank you letter.” But if you are 501(c)(3), a little more nuance is involved. As you likely know, things are never simple regarding the Internal Revenue Service (“IRS”). In certain contexts, for your donors to be able to claim their donations as tax deductible, they have to be able to substantiate or “prove” that they made them to the IRS. While the burden of recordkeeping and substantiating a donation generally falls on a taxpayer claiming a donation, it is still vital for their donee (i.e., your animal organization) to give your donors the proper documentation they will need to be able to do so.

The IRS imposes specific recordkeeping and substantiation rules on donors of charitable contributions (and also some disclosure rules on charities that receive certain kinds of quid pro quo contributions, mentioned in the textbox below!) These requirements are delineated in §170 of the Internal Revenue Code and §1.170A-15 of the Code of Federal Regulations. These may look a little scary, but don’t worry; we’ll help parse through them for you!

In general and most relevant for animal charities, donee acknowledgment letters come into play when a donor wishes to claim a tax deduction on their federal tax return for:

- A charitable contribution of funds;

- Or a donation of goods to a qualified organization.

There are different kinds of requirements for substantiating each kind of donation. When it comes to a donation of money, a donor must have a bank record or written communication from a charity for any monetary contribution to take a deduction. Additionally, before a donor can claim a charitable contribution on their federal income tax return for any single contribution of $250 or more, they are responsible for obtaining a written acknowledgment from a charity that complies with IRS requirements. For gifts of property other than cash, a taxpayer must also provide a written acknowledgment that meets specific requirements and may also need to provide additional information if a contribution is valued over $5000.

What Does The Burden Of Substantiation Or Burden Of Proof Mean When It Comes To Donee Acknowledgment?

When we say the burden of proof falls on the taxpayer claiming a deduction, what we mean is that in the case the IRS decides to audit a taxpayer and questions their charitable donations, the taxpayer, NOT the charity, is then responsible for providing the “proof” that they donated. This is where a donee acknowledgment letter from your animal organization comes in! While your donors do not need to provide acknowledgments upon filing a tax return, they should keep them on hand in case of an audit when they may be asked to provide them to the IRS. It is also good for your organization to keep copies of all acknowledgment letters you issue in case your donors lose track of their letters! In the case of an audit, they will be very grateful if you can provide a backup copy. Also note that while generally, this burden of proof of proving a donation falls on taxpayers, there have been cases where nonprofit organizations have been audited and asked by the IRS to show copies of the donee acknowledgment letters that they sent to donors. Again, good recordkeeping practices are essential for your organization!

We will run through the requirements for donee acknowledgment letters for cash donations and property donations below! And for even more detailed and specific information, you can also check out IRS Publication 1771, Charitable Contributions: Substantiation And Disclosure Requirements.

The Obligations Of A Charity Under The IRS Substantiation Rules.

While this resource is largely focused on the question of donee acknowledgment letters, which help your donors fulfill their burden of substantiating their donations, it is also important to note that charities bear the burden of some disclosure requirements. For example, the IRS generally requires that charitable organizations provide a written disclosure to a donor who receives goods or services in exchange for a single donation above $75. We will discuss this concerning quid pro quo donations below. If you frequently offer goods or services in exchange for donations in of $75 or more, you should consult with a nonprofit attorney or tax professional to figure out a protocol for your ongoing documentation in this regard.

What Is The Timeline For Sending A Donee Acknowledgment Letter?

The IRS requires that donee acknowledgment letters be “contemporaneous.” What this means is that your organization should send written acknowledgment to your donors no later than January 31st of the tax year of the donation. For the donor’s donation to be deductible, the donor must get their acknowledgment by the earlier of either:

- The date that they actually file their tax return for the year in which they are claiming the contribution; or

- The due date of the return (including extensions.)

In practice, we recommend you issue a donee acknowledgment letter as soon as possible after receiving a donation and for each and every donation. Don’t wait until your donor reaches the $250 threshold, where they absolutely require an acknowledgment letter to take a deduction. It’s ultimately better protocol to acknowledge each donation as it comes. Not only is it gratifying to your donor to receive a prompt thank you, no matter the size of their donation, but it can also help prevent a lot of year-end headaches, where you might find yourself having to issue acknowledgments for all the past year’s donations!

Consider, for example, the donor who contributes $10 dollars here and $50 dollars there. Their donations may add up to more than $250 by the end of the year! By acknowledging each of these contributions, you not only give them much-deserved gratitude, but you also save the toil of adding up donations from each individual donor at the end of the year to figure out if their donations total more than $250! So our recommended best practice is to issue an acknowledgment for each and every donation you receive shortly after receipt.

A Note About Follow-Up With Donations Made Via Social Media

Many organizations rely on fundraising through their social media channels. While Facebook and Instagram fundraisers, for instance, will generate receipts for your donors, which can serve as substantiation for their donations, there is a significant catch for organizations that rely exclusively on these fundraising platforms. In short, it’s tough to track down information on the donors who contribute to your organization in this way. Doing follow-up and stewardship is near impossible and can lead to a reliance on social media platform fundraising that can prove problematic if your organization has social media glitches or if the platforms change their content-publicizing algorithms substantially without notice, as is often the case.

What Should a Donee Acknowledgement Letter Include?

While it’s nice to send a simple personalized thank you note, if you are a 501(c)(3), your donors will require some precise information in their letter, which is not intuitive, so you need to know what your donors need to substantiate their donations. The IRS explicitly requires certain elements to be in donee acknowledgment letters. These may differ depending on whether you received a simple donation of funds or whether your organization gave goods or services to the donor in return. There are additional nuances with certain kinds of donations. We will address each of these issues, starting with the most straightforward kind of donee acknowledgment letter, which involves when your organization receives a gift of funds.

Donee Acknowledgment Of A Cash Donation

When deducting any cash contribution to a charity, a donor must have a bank record or written communication from a charity to substantiate it. And again, when it comes to amounts of $250 or more, donors are responsible for obtaining a written acknowledgment from a charity that complies with IRS requirements.

A written acknowledgment required to substantiate a charitable contribution of $250 or more should contain the following information:

- The name of the organization as well as a statement declaring your organization’s 501(c)(3) tax-exempt status, including your EIN (Employer Identification Number);

- The name of the donor;

- The amount of the cash contribution;

- The date of the contribution;

- A statement that the organization provided no goods or services, if that is the case;

- A description and good faith estimate of the value of goods or services, if any, that organization provided in return for the contribution.

So let’s offer a hypothetical example of a situation where an animal organization must issue this kind of acknowledgment and a sample for you to look at!

These Really Are Hypothetical!

All hypothetical scenarios offered in this resource are indeed hypothetical: they are not based on any “real-life situation” They are meant for educational purposes only.

Cathy Gives Cow Haven A Cash Gift!

Cathy Cowfriend, a resident of the state of Winnemac, is an activist with a soft spot for cowsWhile "cows" can be defined to refer exclusively to female cattle, at The Open Sanctuary Project we refer to domesticated cattle of all ages and sexes as "cows.". She attends slaughterhouse vigils in the city of Zenith, and at one of these, a disabled calf is rescued by activists. Luckily, these activists are well attuned to the considerations that accompany responsible rescue and have long-standing relationships with local sanctuaries (at which they also volunteer) and so when they receive the calf, named Fernando, they are promptly able to aid in his transport to a veterinarian for assessment, and ultimately bring him to a sanctuary in-state called CowWhile "cow" can be defined to refer exclusively to female cattle, at The Open Sanctuary Project we refer to domesticated cattle of all ages and sexes as "cows." Haven. Cathy is a part of the transport team and forms a special bond with Fernando. She is so grateful to Cow Haven that she decides to donate $500 to them for the ongoing care of their residents.

Cow Haven is, of course, grateful for this donation and also realizes that they must issue Cathy a donee acknowledgment letter. What should this letter look like? Take a look at the sample below! Note that this letter meets the requirements of the IRS when it comes to donee acknowledgment, AND it adds a unique personalized touch. While not required by the IRS, adding elements like this can help make your donors feel like their donation is valued and appreciated by you and can inspire them to give even more!

What About Donations Where Your Organization Gives A Gift In Return?

Sometimes your animal organization may offer your donors gifts when they give donations. This may or may not have implications for your donee acknowledgment requirements. The IRS generally requires that donee acknowledgment describes goods or services an organization provides in exchange for a contribution of $250 or more. It must also provide a good faith estimate of the value of the goods or services because a donor must generally reduce the contribution deduction amount by the fair market value of the goods and services provided by the organization. Goods or services include cash, property, benefits, or privileges. However, there are a couple of important exceptions!

One such exception is offering “insubstantial goods or services” in return for a donation. These do not have to be described in the acknowledgment. But what does “insubstantial” mean exactly? Under IRS Publication 1771, goods and services offered by a nonprofit in exchange for donations are considered to be insubstantial if they are offered in the context of a fund-raising campaign in which your organization informs the donor of the amount of the contribution that is deductible, AND:

- The fair market value of the goods or services received does not exceed the lesser of 2% of the donation, or $106; OR

- The donation is at least $53, AND the only items provided in exchange for the donation have your organization’s name or logo on them (like calendars, totes, mugs, or posters), AND the cost of these items is within the cost limit for “low-cost articles.” As of 2016, that limit was $10.60.

- Free, unordered “low-cost articles” are also considered to be insubstantial. For example, if your organization sends stickers along with donee acknowledgments, this would be considered a “low-cost article” exception.

So let’s consider our above hypothetical with Cow Haven and Cathy Cowlover again. Imagine that Cow Haven sent Cathy a free T-shirt with their logo and a picture of Fernando, the calf she assisted. The shirt is worth $25. Does Cow Haven need to describe the T-shirt in their donee acknowledgment? The answer is no. This thank-you gift meets the first exception. The value of the T-shirt is only .05% of Cathy’s donation of $500. We will revisit what your organization should do when goods and services are provided that do NOT meet the exception above below in the section on quid pro quo donations!

A Note On The Adjustment Of Guideline Amounts.

The IRS periodically adjusts the value of “insubstantial goods and services.” We have relied here on the amounts provided by IRS Publication 1771. However, it is a good idea to check in with your tax advisor to get updates on current numbers when determining an “insubstantial good or service” or a “low-cost item.”

Another exception your animal organization should know about has to do with “membership benefits.” Under Publication 1771, the IRS explains that annual membership benefits are also considered insubstantial if provided in exchange for an annual payment of $75 or less and consist of annual recurring rights or privileges like:

- Free or discounted admissions to the charitable organization’s facilities or events;

- Discounts on purchases from the organization’s gift shop;

- Free or discounted parking;

- Free or discounted admission to member-only events sponsored by an organization with a per-person cost (not including overhead) within the “low-cost articles” limits.

So let’s revisit Cathy and Cow Haven again. What if Cow Haven offers supporters a “membership” to their sanctuary? They do this with donors like Cathy and call it the “Cow Club.” For a donation of $75 annually, members of the Cow Club get to come to all sanctuary events without giving the suggested donation of $5, and they get a free Cow Haven calendar, which features its logo and a picture of a different resident each month. The calendar costs Cow Haven $10 to print.

Does Cow Haven need to mention the benefits they have offered Cathy and other members of the Cow Club in their donee acknowledgments? The answer again is no. The free admission to Cow Haven’s events falls within the membership exception. The free Cow Haven calendar falls within the second “insubstantial goods and services” exception discussed above because the calendar costs less than $10 and bears Cow Haven’s logo.

What’s A Quid Pro Quo Donation?

If your organization offers goods and services to donors that do not fall within one of the above exceptions, it is known as a quid pro quo donation. Your donors may only take contribution deductions to the extent that their contributions exceed the fair market value of the goods or services the donor receives in return for the contribution. In cases where donors receive goods or services that do not fall within one of the above exceptions, they will need to know the value of the goods or services. This is where the burden of substantiation (mentioned in the textbox above) shifts and falls upon your organization.

You must provide a written disclosure statement to a donor who makes a payment exceeding $75, partly as a contribution and partly for goods and services provided by the organization. A contribution made by a donor in exchange for goods or services is known as a quid pro quo contribution.

Cathy And Cow Haven Revisited: A Quid Pro Quo Donation

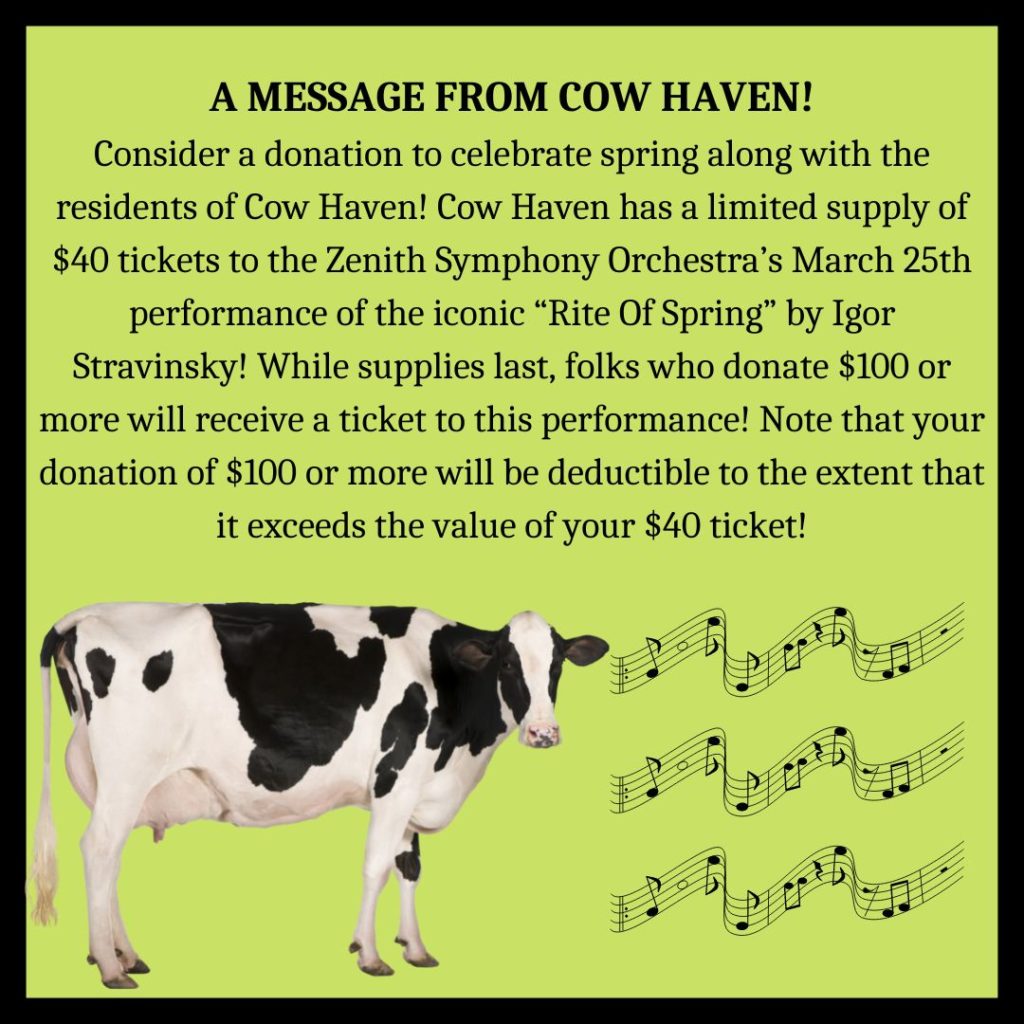

Because understanding these rules in the abstract can be confusing, let’s revisit Cathy Cowfriend and Cow Haven again and think of another example to illustrate these rules. Let’s consider what might happen if Cow Haven gets a donation of concert tickets from the Zenith Symphony Orchestra for a performance of “The Rite Of Spring.” Cow Haven is thrilled! Each of these tickets is worth $40. They run a March fundraiser to offer these tickets to donors who give more than $100.

Cathy is a big Stravinsky fan, and she is thrilled and immediately jumps on board, donating $100 to Cow Haven! She gets to see the performance and support the sanctuary she loves with a tax-deductible donation! Not so fast, Cow Haven and Cathy!

This is a case of a quid pro quo donation. On Cathy’s part, she can only claim $60 as a tax-deductible donation to Cow Haven. And because Cathy’s payment to Cow Haven exceeds $75, it triggers a written disclosure on the part of Cow Haven, which must:

- Tell Cathy her deduction for federal income tax purposes is limited to $60, the difference between her contribution and the value of the concert tickets; AND

- State the “good faith estimate of value” of what she has received as a quid pro quo: in this case, a concert ticket with a value of $40.

Cow Haven can fulfill its disclosure requirement as part of its solicitation in this fundraising campaign or when receiving Cathy’s donation. It’s good practice to do both, and is a helpful way that your organization can help maintain its reputation for accuracy and transparency! This way, donors who plan their charitable giving are fully aware of the limitations on their deduction before they donate, and they are reminded of this again when they receive their donee acknowledgment letter.

So in planning their fundraising campaign around this quid pro quo donation, Cow Haven added the following to all their emails and social media posts:

Adding language like this to your posts in fundraisers involving quid pro quo donations is very helpful in promoting your sanctuary’s commitment to accuracy and transparency. Reading this, donors are made fully aware of the limitations of the deductibility of any donation they may make in this particular campaign. This brings us to how a donee acknowledgment letter should look in the context of a quid pro quo donation. Here’s a sample based on this same hypothetical:

Penalties Associated With Charity Nondisclosure.

Remember how we mentioned the “burden of proof above?” Quid pro quo donations are an example of where your organization (not the taxpayer) bears the requirement of providing substantiation, and you may face penalties for not doing so. Specifically, a penalty is imposed on charities that do not meet the written disclosure requirement. The penalty is $10 per contribution, not to exceed $5,000 per fundraising event or mailing. An organization may avoid the penalty if it can show that failure to meet the requirements was due to reasonable cause.

What About Noncash Donations To Your Animal Organization?

Regarding gifts to your animal organization besides cash, you should also be providing your donors with acknowledgment letters. When it comes to non-cash donations, the amount of the allowable deduction that your donors can claim on their federal income tax return is the property’s fair market value at the time of the contribution. Your organization is NOT responsible for estimating this value, nor should you do so in your acknowledgment or otherwise! Your donor is responsible for substantiating the value of a non-cash donation and will have unique requirements in so doing, discussed in the textbox further below. So what should you do when you receive a non-cash donation? You should issue your donor an acknowledgment including the following:

- The name of the organization as well as a statement declaring your organization’s 501(c)(3) tax-exempt status, including your EIN (Employer Identification Number);

- The name of the donor;

- A description (but not a value) of non-cash contribution;

- The date of the donation;

- A statement that no goods or services were provided by the organization, if that is the case;

- A description and good faith estimate of the value of goods or services, if any, that the organization provided in return for the contribution.

So let’s revisit Cathy and Cow Haven in Winnemac, and consider an example of a non-cash donation and show you a sample donee acknowledgment letter for this.

Cathy Gives Cow Haven Some Cow Fly Masks!

Cathy is back! She’s so enchanted with Cow Haven that she’s trying to think of ways to help them going forward! She has become a frequent volunteer at the organization and has noticed that one of the issues residents face is the question of flies. Specifically, one of Fernando’s friends, Roberto, seems very bothered by flies. She checks with Polly Placket, the Executive DirectorThe individual formally in charge of final decision making at an organization, who sometimes works closely with the organization’s Board of Directors. Sometimes a Founder is an Executive Director, especially early in a nonprofit’s growth stages. of Cow Haven, who affirms that several residents have been made more comfortable with fly masks and feel several more residents may also find more comfort in using them.

As a result, Cathy negotiates a discount with a supplier and purchases multiple fly masks, typically valued at $750 for Cow Haven, for a grand total of $500. She sends them to Cow Haven, and the Cow Haven staff immediately puts them to use on residents who are already acclimated to them and start working with even more residents to get them comfortable with their use.

A Tip For Sanctuaries Receiving Donations Of Property By Delivery!

Sanctuaries may get donations of goods from online wishlists or donors who see a particular need they may be able to fulfill by sending gifts of property. It is a good idea to have staff and volunteers who receive sanctuary parcels be aware that in the case that donations of property are shipped to the sanctuary, they should take special note and keep track of these in a way so that the administration or other staff in charge of acknowledging donations are aware of what was received, the date it was received, and who sent it!

What should Cow Haven’s donee acknowledgment letter look like in this case? Remember that, again, the burden of substantiation falls on Cathy. While Cow Haven should absolutely acknowledge the donation, it is not their responsibility to set a value on the donation of the fly masks, nor should they. They are not qualified appraisers under IRS guidelines, and it is incumbent on Cathy, NOT Cow Haven, to establish the fair market value of the fly masks when it comes to her substantiating her charitable donations to the IRS.

Contributions Of Property Above $5000 – Tips For Donors.

If you have contributed a donation of property valued at more than $5000, you will need to secure a qualified appraisal by a qualified appraiser to substantiate the value of this donation. Please note that the term “qualified” in this context has specific legal significance, both concerning the question of the appraiser and the appraisal, and comes with specific IRS guidelines. There are exceptions to this rule, but you must consult your tax professional to determine whether your gift falls into these exceptions and learn more about IRS requirements around qualified appraisals and appraisers! Also note that appraisals must be paid for and arranged by you, NOT the organization to whom you have given the gift. You cannot deduct appraisal fees as part of the contribution, nor can your donee pay for it in any way.

How About Acknowledging Unreimbursed Expenses By Volunteers And Donors?

When donors incur expenses on behalf of a nonprofit organization that are unreimbursed, they may be able to deduct these as charitable donations as well! For more information on this, check out IRS Publication 526. The requirements for donee acknowledgment will also be different in this case. Here, your organization should provide your donor with a written acknowledgment that includes the following:

- A description of the unreimbursed expenses that the donor incurred;

- A statement of whether or not your organization provided goods or services in return for this contribution;

- A description and good faith estimate of the value of goods or services, if any, that your organization provided in return for the contribution.

Please note that it’s essential that your organization and any volunteer or donor wishing to contribute in this way agree in advance so that you are prepared to issue an appropriate donee acknowledgment.

Tip For Donors Who Wish To Take Deductions For Unreimbursed Expenses

If you as a donor wish to take a deduction for this kind of contribution, you must maintain adequate records of the unreimbursed expenses. For more information on the kinds of records you need, you should both consult with your tax professionals, and you can consult IRS Publication 526, which provides a list of the records that will be required.

To consider how to acknowledge this kind of donation, let’s look at Cathy and Cow Haven’s recent adventures! Recently Polly Placket, the Executive Director of Cow Haven, learned about another disabled calf in far downstate Winnemac. She has the capacity to take on this individual and needs transportation aid to get him from his current location in Gopher Prairie to her veterinarian at the University of Winnemac in Zenith and then ultimately back to Cow Haven. Given her current constraints with on-site sanctuary demands, Polly puts out a call for assistance from volunteers.

Guess who answers? That’s right! The work with Cow Haven so gratifies Cathy that she is thrilled to help out more. She offers to rent a trailer and pay for the gas expenses for both transports. All she asks is that the new calf is named Alejandro. Polly, of course, finds this name delightful and is thrilled to accept Cathy’s help and provide her with a donee acknowledgment for her unreimbursed expenses.

The expenses total $500 for gas and $200 for the trailer rental. What should Cow Haven’s donee acknowledgment letter look like in this circumstance? Take a look below:

A Note To Donors Wishing To Deduct Unreimbursed Expenses Incurred On Behalf Of Nonprofit Organizations.

Remember that for her to substantiate her charitable donation to the IRS, in addition to keeping her donee acknowledgment letter from Cow Haven, Cathy will also need to keep her receipts for the rental of the transport trailer and her gas receipts! It’s good to keep these records along with your donee acknowledgment letter so they are easily accessible in the case of an audit!

What About The Donation Of Professional Services? Are Those Deductible? Does My Organization Need To Provide A Donee Acknowledgement Letter For These?

If your animal organization is lucky enough to benefit from the donation of professional services (such as accounting, legal, or consulting services), it’s essential to note that the cost of these services is NOT deductible to donors. Most professional services are billed hourly, and while pro bono work by professionals is essential and beneficial, sadly, the time professionals spend is generally not recognized as an expense they can deduct from their federal income taxes. Generally speaking, as a professional donating services, you CANNOT:

- Deduct the standard fee for the time you donate (but you can deduct qualified expenses that you incur to provide those services); or

- Deduct expenses that benefit you more than the charity, such as the cost of equipment you continue to use.

If your sanctuary is asked to provide a donee acknowledgment letter for the provision of professional services, you should look critically at the request. You absolutely can and should thank professionals who contribute their time to support your missionThe stated goals and activities of an organization. An animal sanctuary’s mission is commonly focused on objectives such as animal rescue and public advocacy. and sending a thank you letter is warranted. However, a formal donee acknowledgment letter is not required in these cases because these kinds of services are not tax-deductible to the donor of the services, aside from specific tangible expenses that are associated with the work that the professional did for you, and which will benefit you long term more than they will the professional. Acknowledging those kinds of expenses would fall under the category of “unreimbursed expenses,” as in the example of Cathy renting a trailer and paying for gas for the transport of Alejandro, described above.

While it might feel frustrating that you can’t provide a benefit with regards to tax deductibility for professionals who donate their time to your organization, note, however, that many professionals benefit from logging pro bono work hours, whether it be from their accrediting organizations (such as bar associations) or in their own marketing. You can also do other things to acknowledge donors of services, such as giving them a shout-out on social media and giving referrals to them to others!

A Note On Contributions Of Art, And A Tip For Artists

The intersection between art and activism can be exciting, and it is lovely that so many animal organizations are finding intersections with artists who want to support their cause! However, it’s essential for artist donors who are contributing their work to nonprofit organizations to know that there are special restrictions around the deductibility of these kinds of gifts. The creation of art essentially falls under “the provision of services,” discussed above, which means that the time you spend creating the work of art is a service, the cost of which is generally not considered deductible. If you are donating artwork to a nonprofit organization, you should consult with your tax professional about the deductibility of these kinds of donations. In general, the rule is that artists may not deduct more than the cost of the materials that they used to make their art from their federal income tax! So if, for example, Paula Painter gives Cow Haven a portrait of Fernando for their yearly charity auction, she can only deduct the value of the paint and canvas she used, NOT the market value of the portrait OR what it sells for at auction!

Conclusion

We hope this resource has helped explain what burdens your organization bears legally concerning acknowledging and disclosing information to the IRS regarding different kinds of charitable donations. It’s always important to remember that even when the burden of substantiation falls on your donors, sending acknowledgment letters is essential to ongoing donor stewardship and can help build your relationship with your donor base. Below are some basic templates for your organization’s use concerning donee acknowledgment. Please remember to consult with your attorneys and tax professionals concerning your adaptation of these templates, and we also hope you look at the samples we included in this resource so that you can use them as inspiration when it comes to personalizing letters in a way to build ongoing support!

Enter your organization’s (or your) name and email below to download our free downloadable templates to assist you in crafting your sanctuary’s donee acknowledgment letters.

We promise not to use your email for any marketing purposes! Would you prefer to access this form in a different way? Contact us and let us know!

How Are These Templates Working For You?

Have you used these templates at your sanctuary and want to give us feedback on improvements? Let us know here!

Action Steps

- When your organization receives a donation, determine whether it is a cash donation, a quid pro quo donation, a gift of property, or a request for the reimbursement of expenses incurred on the behalf of your organization.

- Once you make that determination, you can choose an appropriate template for crafting your acknowledgment letter, which is best done for every donation you receive. Don’t wait until the end of the year to issue acknowledgments; instead, send them as soon as practicable after receiving the donation. This is not only best practice from an administrative standpoint but also good donor stewardship! Make sure to personalize letters for your donors as much as possible while including every element required by the IRS.

- If you have questions or doubts regarding how you should respond to any given donation, consult with your legal and tax professionals to make sure you are complying with all legal requirements, including your organization’s disclosure requirements.

Infographic

Requirements For Donee Acknowledgement Letters – Flow Chart by Julia Magnus

The first column is titled “Cash Donation.” Underneath are a series of bubbles, all colored yellow.

Bubble 1 reads:

Bubble 1 reads: Donors Must Have A Written Acknowledgment Of Donations Of $250 Or More Which Includes:

Bubble 2 reads: The Name Of Your Organization, Your EIN, And The Donor’s Name

Bubble 3 reads: The Amount And Date Of The Contribution

Bubble 4 reads: A Statement That No Goods Or Services Were Provided In Exchange

Bubble 5 reads: A Statement Declaring Your Organization’s Tax-Exempt Status

The second column is titled “Donation Of Goods.” Underneath are a series of bubbles, all colored orange.

Bubble 1 reads: Donors Must Have A Written Acknowledgment Which Includes:

Bubble 2 reads: The Name Of Your Organization, Your EIN, And The Donor’s Name

Bubble 3 reads: The Date Of The Donation

Bubble 4 reads: A Description Of The Goods Donated But NOT A VALUE

Bubble 5 reads: A Statement That No Goods Or Services Were Provided In Exchange

Bubble 6 reads: A Statement Declaring Your Organization’s Tax-Exempt Status

The third column is titled: “Unreimbursed Expenses.”

Underneath are a series of bubbles, all colored pink.

Bubble 1 reads: Donors Must Have A Written Acknowledgment Which Includes:

Bubble 2 reads: The Name Of Your Organization, Your EIN, And The Donor’s Name

Bubble 3 reads: The Date Of The Donation

Bubble 4 reads: A Description But NOT A VALUE

Bubble 5 reads: A Statement That No Goods Or Services Were Provided In Exchange

Bubble 6 reads: A Statement Declaring Your Organization’s Tax-Exempt Status

The fourth column is titled “Quid Pro Quo – Substantial Gift”

Underneath are a series of bubbles, all colored green.

Bubble 1 reads: Donors Must Have A Written Acknowledgment Which Includes:

Bubble 2 reads: The Name Of Your Organization, Your EIN, And The Donor’s Name

Bubble 3 reads: The Date Of The Donation

Bubble 4 reads: A Description Of The Goods Or Services You Provided

Bubble 5 reads: A Good Faith Estimate of The Goods And Services You Provided

Bubble 6 reads: A Statement Declaring Your Organization’s Tax-Exempt Status

The fifth column is titled “Quid Pro Quo – Insubstantial Gift”

Bubble 1 is colored blue and reads: Double Check To Make Sure That Your Gift To Your Donor Falls Within The IRS Insubstantial Gift Exceptions

Bubble 2 is colored yellow and reads: If Your Donor Gave You Cash, Follow The Rules For A Cash Donation Acknowledgment Letter

Bubble 3 is colored orange and reads: If Your Donor Gave You Goods, Follow The Rules For A Goods Donation Acknowledgment Letter

Bubble 4 is colored pink and reads: If You Are Acknowledging Unreimbursed Expenses, Follow Those Rules

SOURCES:

Resources On Budgeting And Fundraising | The Open Sanctuary Project

Animal Sanctuary Organizational Record Keeping Basics | The Open Sanctuary Project

Fly Mitigation Strategies For Sanctuary Cow Residents | The Open Sanctuary Project

Charitable Contributions: Substantiation And Disclosure Requirements | Internal Revenue Service

Substantiating Charitable Contributions | Internal Revenue Service

When Are Charitable Receipts Required? | Nonprofit Expert

How To Write A Donee Acknowledgment Letter | Altruic Advisors

When Are Appraisals Required For Donations | NOLO

Publication 526: Charitable Contributions | Internal Revenue Service

Find Out If Pro Bono Services Are Tax Deductible | The Balance